Section 44C of the Income Tax Act ,1961

Section 44C of Income Tax Act, 1961 -Tax Deduction at Source in respect of Head Office expenses of Non Residents.

Tax2

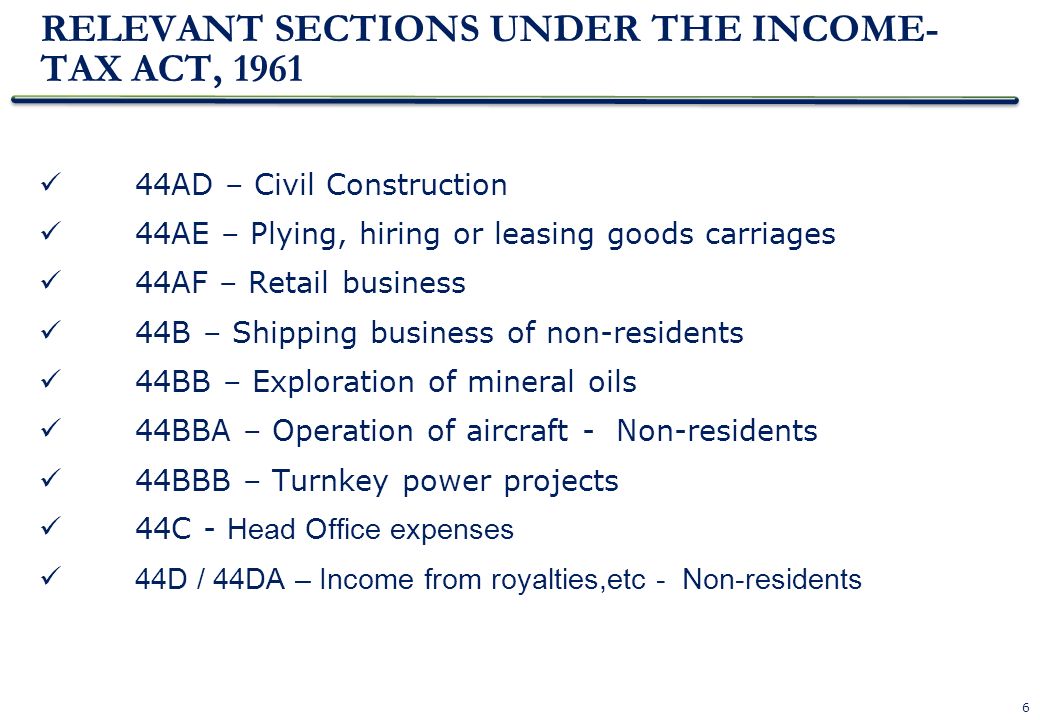

PRESUMPTIVE TAXATION UNDER INCOME TAX ACT,1961

FAQs on Section 115A – Tax rates for specified income of non

Income Tax Rules Articles - IndiaFilings

Section 44C of the Income Tax Act ,1961

Clause 44 in Form 3CD under Section 44AB of Income Tax Act 1961

Tax Audit under section 44AB of Income Tax Act, ppt download

Deduction on account of Sec 44C of Income Tax Act can be claimed

Section 54EC of Income Tax Act 1961 - Decoded!

International Taxation Case Studies Compiler, PDF, Loans

Tax Auditing Service-Tax Seva Kendra

CA Viral Mittal on LinkedIn: *INCOME TAX PORTAL UPDATE:* 'ASSIGN

DEEMED BUSINESS INCOME AND PRESUMPTIVE TAXATION - ppt video online

Section 44BBB and Section 44C of Income Tax Act - CA Arinjay Jain

_5600_4000_65.jpg)